This is Part 8 of Brazilstrat’s series about the Brazilian Unicorns. Links to the other parts can be found here: “Part 1 – Introduction and Summary”; “Part 2 – Nubank”; “Part 3 – Wildlife Studios”; “Part 4 – iFood”; “Part 5 – Loggi”; “Part 6 – QuintoAndar”; “Part 7 – Ebanx”; and “Part 9 – Gympass”.

Brazilstrat is a boutique consulting firm specializing in assisting growth companies with interest in the Brazilian market. Located in São Paulo and Rio de Janeiro, we work with clients who have a business model we believe stands a good chance of success in Brazil, and who operate in an area where we can add significant value through our own experience and network.

Are you considering a Brazil market entry for your growth company, or do you want to know more about Brazilstrat and our reference projects? Contact us to schedule a call.

Loft

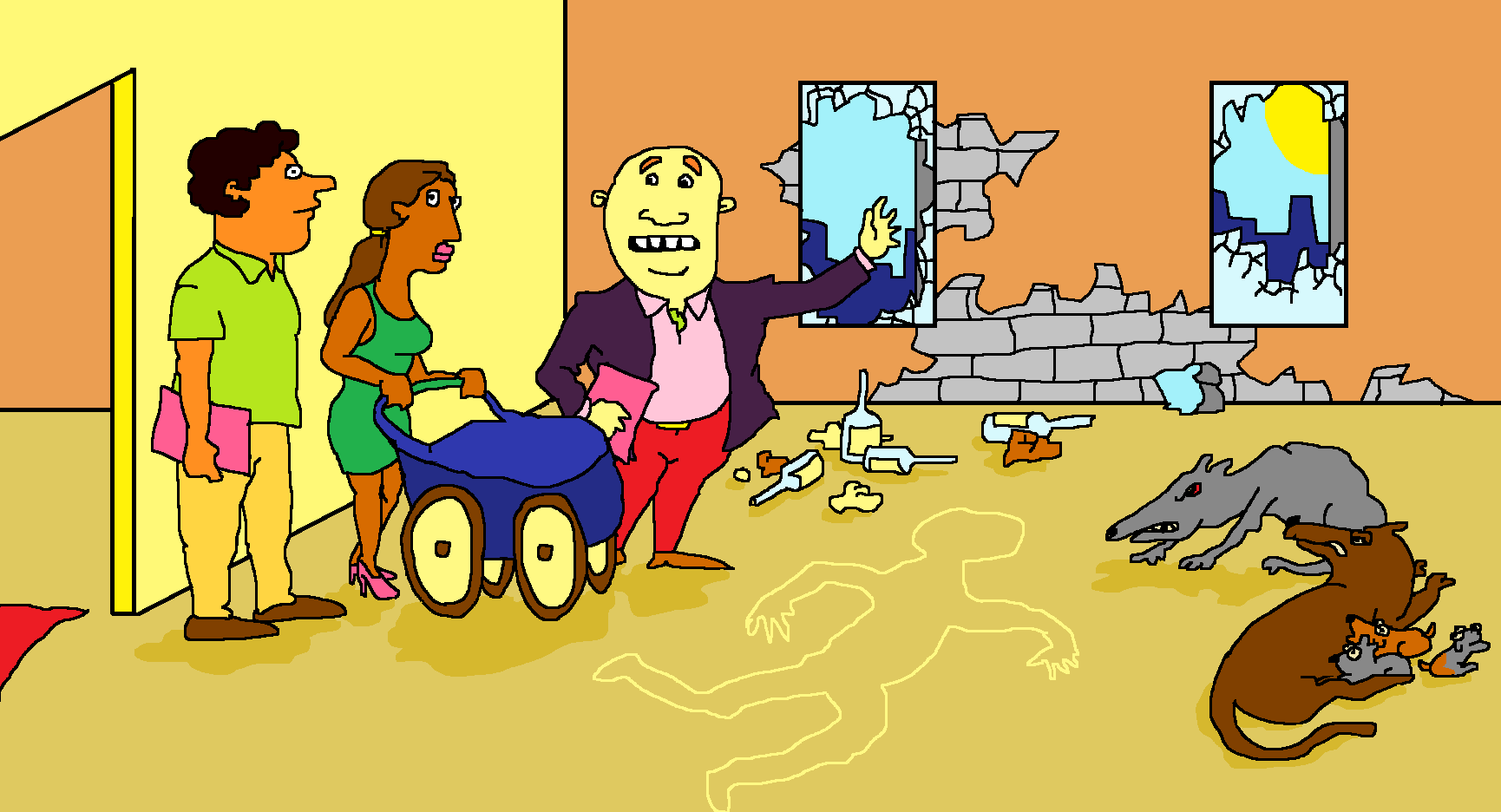

Loft is an online real estate platform using technology to identify, reform, and sell properties after a mark-up up to 45%, with more than 440 employees, six thousand real estate broker partners, over $2 billion worth of apartments sold in 2019, and an inventory of more than 300 apartments for sale[48]. Sometimes described as an “iBuyer”, or instant buyer, Loft’s business model is like that of OpenDoor in the US, and Eric Wu, OpenDoor’s co-founder and CEO is also an investor in the Brazilian startup[47]. From the outside, Loft looks like a marketplace where property sellers and buyers are matched, but the difference is that Loft acts as counterparty for both sides. This makes the business model much more capital intensive than would have been the case for an asset-light marketplace, but also raises profit potential per transaction. Starting with relatively expensive apartments in high-end neighbourhoods of São Paulo, Loft’s initial strategy was to buy old apartments for BRL 6 000-9 000 per square meter and resell for BRL 12 000-16 000 after renovation. Loft has since included cheaper apartments, and in the beginning of 2020, nine neighbourhoods were added to its geographical target area, now covering more than six hundred thousand properties[50]. Further expansion plans include Belo Horizonte, Brasília, Curitiba, Porto Alegre and Rio de Janeiro in Brazil, with Mexico City as their first international target[40].

Loft’s value proposition for sellers is to simplify and speed up the transaction, reducing the time needed to sell an apartment to four months, from 16, which is currently the average in Brazil according to Zap[40]. Loft also offers a digital and seamless buyer experience, including refurbishment and decoration provided through their partners and guaranteed by Loft. This gives buyers a ready-to-live alternative to worn down apartments with no furniture, which is common in the Brazilian second-hand market, with a price that is still as much as 50% lower than for new apartments[40].

Colégio Notarial do Brasil, a federal channel for notary information, indicates that BRL 473 billion (about $93 billion as of April 2020) of real estate was sold in Brazil in 2017, compared to $1.7 trillion globally according to the American real estate services firm Cushman & Wakefield. The second-hand real estate market’s massive size, combined with an opaque, slow and bureaucratic structure, represent big opportunities for innovative companies in Brazil[40]. Loft is not alone, and the Association for Brazilian Startups has estimated that there were 123 “construtechs”, startups operating in the broader construction space, in Brazil in 2019, up from 109 in 2018 and 96 in 2017, although this still represented only about 1% of the country’s 12 100 startups[40]. Loft has managed to stand out, however, and was according to LinkedIn the third most popular startup to work for in Brazil in 2019, while Nubank came in first[39].

Loft was founded in São Paulo in August 2018 by Florian Hagenbuch and Mate Pencz (Co-CEOs and largest shareholders among the founding team), Gustavo Saraiva and Marcus Vinicius Grigoletto (both Head of Engineering), João Vianna (Head of Real Estate), Kristian Huber (Head of Finance and Business Development), and Mariana Paixao (Head of Operations).

Originally from Stuttgart, Germany, Loft’s co-CEO Florian Hagenbuch spent his childhood and teenage years in Brazil, where his father, an executive at a multinational printing company, was transferred when Florian was four. He went on to study finance, international studies and mathematics at The Wharton School in Pennsylvania, US, combined with summer internships at Goldman Sachs and The Blackstone Group in London, where he met Mate Pencz, his future partner. After finishing his studies, Hagenbuch moved to London and worked two years in private equity at Silver Lake Partners, sharing a flat with Pencz. The two moved to São Paulo and co-founded Printi in 2012 with the intention to disrupt the inefficient Brazilian printing market. Printi, where Hagenbuch is still on the board, became Latam’s leading online printing marketplace before eventually being acquired by the US-based, Nasdaq-listed global online printing leader Vistaprint. An active angel investor, Hagenbuch has invested in over 80 companies globally. His investing in Brazil evolved into the formation of Canary in 2016, a seed-stage investment firm with over $150 million in assets under management that has invested in more than 60 companies, including Loft. Hagenbuch became an Endeavor Entrepreneur in 2014, two years after Alphonse Voigt and Wagner Ruiz from Ebanx[41][43].

Mate Pencz, a Hungarian who moved with his family to Stuttgart soon after the Berlin wall went down in 1989, studied economics at Harvard combined with internships at Goldman Sachs and Morgan Stanley in London, where he returned after finishing his studies to work with portfolio management for one and a half years at Alta Advisors. His career has since merged with that of Hagenbuch after they moved to São Paulo in 2012 to found Printi, where Pencz is also still on the board. They both joined Endeavor in 2014, co-founded Canary in 2016, and finally co-founded Loft as co-CEOs in 2018[42].

Gustavo Saraiva[44] and Marcus Vinicius Grigoletto[45] both studied civil engineering at Centro Universitário do Instituto Mauá de Tecnologia in São Paulo, before working a few years in different areas of real estate construction. Saraiva combined this with a post-graduate programme in real estate Management at Fundação Armando Álvares Penteado, while Grigoletto got an MBA in civil engineering at Fundação Getulio Vargas (FGV). They co-founded GDSA Engenharia in 2006 where Saraiva acted as financial manager and Grigoletto as COO for more than 150 projects of construction and remodelling at industrials, commercials and high standard residences. A spinoff from GDSA became Maison São Paulo, which focused on construction services for renovation and modernization in real estate located in high-end areas of São Paulo before Maison became part of Loft as the new company was founded in 2018, with Saraiva and Grigoletto sharing the role of Head of Engineering.

João Vianna graduated in economics from Ibmec in 1999 and spent a few years in various sales and management roles at cosmetics firms Natura and Parallele Purfumes before becoming General Manager Brazil at Groupe Smart&co, a French company in the entertainment intermediation market. He joined Novo de Novo, an investment club focused on high-end real estate investments and renovations around São Paulo, as director and partner in 2011, and in parallel co-founded Spray International Fragrances, a perfume development and licencing company in São Paulo in 2013. In 2016 Vianna joined Saraiva and Grigoletto in forming Maison before the company merged into Loft in 2018, where Vianna became Head of Real Estate[49].

Like Hagenbuch, Kristian Huber also studied finance and international studies at The Wharton School, but while Hagenbuch went to London for his summer internships, Huber interned at Lehman Brothers in New York, just two months before the firm’s notorious collapse in September 2018. After finishing his studies, Huber worked two years at Polo Capital, an independent asset management group based in Rio de Janeiro, followed by six years between São Paulo and New York at Tarpon Investimentos, a value-oriented asset manager, before co-founding Loft as Head of Finance and Business Development. Huber has also spent time on the board of Cremer, a manufacturer of textile and adhesive healthcare products in Brazil, and education services provider Somos Educação as well as Omega Energia, which acts in the operation and acquisition of renewable power generation assets in Brazil, where he’s still active.

Mariana Paixao studied economics with concentration in corporate finance at Ibmec in São Paulo while interning in the venture capital department at Jardim Botanico Investimentos before working with equity research and debt capital markets at Link Corretora (acquired by UBS) and Morgan Stanley, also in São Paulo. She combined her Stanford MBA with internships at MFS Investment Management in Boston and at the Brazilian-owned brewer Anheuser-Busch InBev back in São Paulo before returning to Boston for almost six years at MFS until she again returned to São Paulo and co-founded Loft as Head of Operations[46].

Loft has raised a total of $263 million in three rounds between January 2018 and January 2020[37]. The massive amount of funding over the company’s less than two years of existence can partly be explained by Loft’s business model, as a lot of capital is needed to fund a large inventory of apartments, even though the individual transactions are relatively quick. Valuation growth is nevertheless impressive, as Loft reached a valuation of $370 million less than one year after creation and became the fastest Brazilian startup to achieve unicorn status in January 2020 after only 16 months in operation. Timing, amounts, and investors of Loft’s financing rounds are summarized below[37].

- Series A in January-July 2018: $18 million from New York-based Thrive Capital; São Paulo-based Monashees; London-based MPGI; London-based Greyhound Capital; Nubank co-founder and CEO David Vélez; San Francisco-based entrepreneur, angel investor, and general partner at Gradient Ventures, Darian Shirazi; São Paulo-based early stage venture capital firm, Canary (founded by Hagenbuch and Pencz); San Francisco-based Andreessen Horowitz; Max Levchin of Paypal; Eric Wu of OpenDoor; and Joe Lonsdale of Palantir[47].

- Series B in March 2019: $70 million from Valor Capital Group, an investment firm focused on Brazil and US-Brazil cross-border opportunities with a presence in New York, Menlo Park, and São Paulo; Thrive Capital; Virginia, US-based QED Investors; Monashees; Greyhound Capital; Venice, California-based Fifth Wall; David Vélez; Canary; and Andreessen Horowitz.

- Series C in January 2020: $175 million from Vulcan Capital, the Seattle-based investment arm of Microsoft co-founder Paul Allen; Valor Capital Group; Thrive Capital; QED Investors; Monashees; Fifth Wall; and Andreessen Horowitz.

Leave A Comment